Transport Services to Brazil

The Country of Brazil

The Federative Republic of Brazil, commonly known as Brazil, is a federal republic located in South America. It boasts the largest area on the continent, bordering Uruguay, Argentina, Paraguay, Bolivia, Peru, Colombia, Venezuela, Guyana, Suriname, and French Guiana (meaning all South American countries except Chile and Ecuador). Additionally, the country includes the Fernando de Noronha archipelago, Trindade Island, Martin Vaz Island, and the Saint Peter and Saint Paul Archipelago in the Atlantic Ocean. Brazil's land area is approximately 22.5 times that of Japan, and while it is about 1.1 million km² smaller than the United States (similar in size to Colombia), it is larger than all of Europe excluding Russia. The capital is Brasília.

As the largest country in South America by area, Brazil also holds the largest territory and population in Latin America, ranking fifth in the world by area. It is the only Portuguese-speaking country in North and South America and has the largest population of Portuguese speakers globally. Brazil has the largest economy in Latin America and is the seventh-largest economy in the world.

Brazilian logistics are characterized by high costs, accounting for 17% of GDP and 11.19% of corporate revenues. According to an IMF survey, Brazil's nominal GDP is $2.1736 trillion in 2023, making it the ninth-largest economy globally and the top economy in South America.

In Brazil, challenges include traffic congestion due to a heavy reliance on truck transport and high logistics costs. Expanding the railway transport network plays a crucial role in the transport of general cargo such as grains, fertilizers, raw materials for steelmaking, and steel products.

The import and export procedures in Brazil are governed by the Ministry of Development, Industry, and Foreign Trade's regulatory decree No. 23 issued on July 14, 2011, which has undergone nearly 354 amendments, additions, and abolitions by June 2023, making its content complex and difficult to navigate. Recent amendments have focused on simplifying regulations. Customs regulations for imports are based on the Brazilian Federal Revenue's Normative Instruction No. 680 from 2006, while exports are governed by Normative Instruction No. 28 dated April 27, 1994, both of which have been amended more than ten times. To simplify export customs procedures, the "Single Export Declaration (DUE)" was introduced on March 21, 2017, followed by the "Single Import Declaration (DUIMP)" in July 2021.

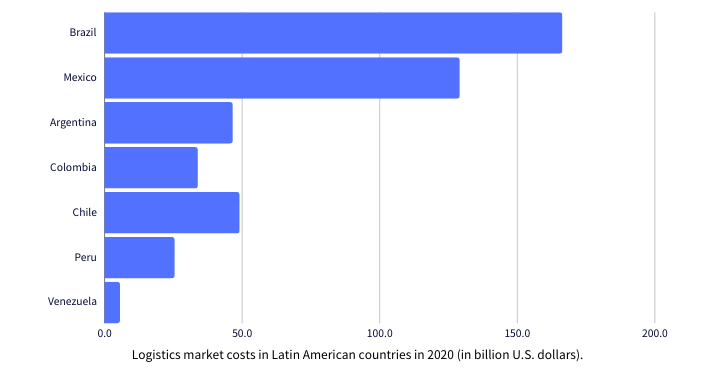

Comparison of Logistics Costs in Central and South American Countries

Cargo Transport from Japan to Brazil

Maritime Transport

| SANTOS | 35~42days |

| PARANAGUA | 35~45days |

| Major Shipping Lines | CMA, Safmarine/Maersk, Hamburg Süd, COSCO, MSC, EVERGREEN, ONE |

Customs Clearance

| About 7 ~ 10days | ← This is only a rough estimate of the time required for import customs procedures.

(Provided that the importer meets all conditions and there are no issues with the documents) ※Please note that customs clearance may be significantly delayed due to sudden rule changes or strikes.

|

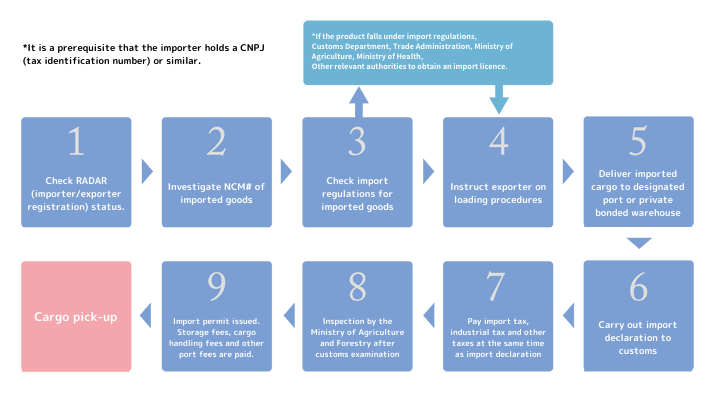

Typical Process for Import Procedures in Brazil

Import Regulations

Import Tax System

The following taxes are imposed upon importation

Federal Taxes

| Import Duty / I.I. | Applied to the CIF value of imported goods, with a tax rate ranging from 0% to 35%, and an average rate of around 14%. |

|---|---|

| Tax on Industrialized Products / IPI | A tax on the removal of industrial products from customs facilities. |

| Social Integration Program Contribution / PIS | The tax rate varies depending on the product. |

| Social Security Financing Contribution / CONFINS | The tax rate varies depending on the product. |

State Tax

| Tax on the Circulation of Goods and Services / ICMS | A value-added tax collected by each state. |

|---|

※By the time the import process is completed and the cargo fees are confirmed, the cost may increase to more than three times the export value.

Import Regulations

Importing equipment and used goods may require prior application and permission from the relevant Brazilian authorities.。

※It is possible to confirm this by cross-referencing the NCM# (Brazilian HS CODE) in advance.

Common Customs Troubles

Document Deficiencies: This is the most common source of trouble.

Issues may arise from deficiencies in the INVOICE, omissions of NET WEIGHT, model and type names of import/export goods, manufacturer names, and manufacturing dates. Mistakes in B/L mentions and omissions of freight charges are also common issues.

Differences in Interpretation with Customs Officers

Differences in Interpretation with Customs Officers:

Each customs officer has their own areas of expertise and may have varying levels of experience. An inexperienced customs officer may lead to unexpected customs inspections. This can happen even with regular cargo.

In Brazil, customs officers rotate among bonded warehouses every few months. Therefore, it is possible for cargo to be moved to the officer's favored customs officer depending on the CNEE.

In Brazil, customs officers rotate among bonded warehouses every few months. Therefore, it is possible for cargo to be moved to the officer's favored customs officer depending on the CNEE.

Precautions for Shipments to Brazil

1. The B/L must clearly state “ORIGINAL B/L” and “FREIGHT SHOW ON.”2. Prepare three sets of the commercial invoice with handwritten signatures.

3. Have you confirmed the NCM# (Brazilian import statistical commodity code) in advance? → This must be included in the B/L and commercial invoice.

※If there is a mismatch, fines may range from 1% to 100% of the CIF VALUE.

4. Have you verified the import regulations and obtained the necessary import licenses for the products?

Rules Regarding FREE TIME

The CY storage fee, commonly referred to as DEMURRAGE (called DETENTION on the Brazilian side), is settled directly between the CONSIGNEE and the TERMINAL. Additionally, the container rental fee, generally referred to as DETENTION (known as DEMURRAGE in Brazil), is mostly determined by the shipping companies operating in Brazil, which can take time for negotiations. Therefore, it is essential to apply with ample time during the BOOKING process. This commonly refers to the container rental fee (referred to as DEMURRAGE in Brazil) only. The FREE TIME tariff is approximately 10 to 20 days for DRY containers and around 10 days for FL containers. (Note: Rules may vary by shipping company. Please inquire at the time of booking.)

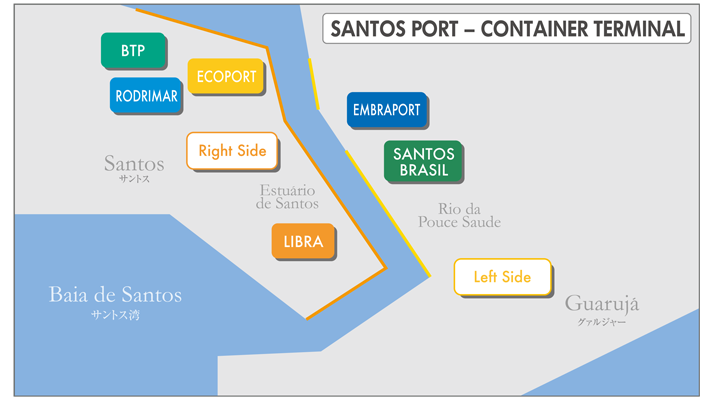

TERMINALS DETAILS

横にスクロールしてください

| Ecoporto | Santos Brasil | Libra | Embraport | BTP | Rodrimar | |

|---|---|---|---|---|---|---|

| Area | 135.000㎡ | 596.000㎡ | 380.000㎡ | 33,617,000 | 32,529,000 | 31,700,000 |

| Max Draft | 13.6mts | 14.2mts | 13.4mts | 13.6mts | 13.6mts | 12.10mts |

| Berths | 815mts | 1.120mts | 1.50 % | 23,278,000 | 22,940,130 | 22,569,800 |

| Capacity to handle | 700.000teu | 2.000.000teu | 775.000teu | 1.200.000 teu | 1.200.000teu | 250.000teu |

| Shore Equipment | 7MHC | 13 Gantry cranes+1MHU |

10 Gantr cranes |

6 Gantr cranes |

8 Gantry cranes |

3 MHU |

Secured Space with Multiple Shipping Companies

We efficiently handle all oversized cargo to destinations worldwide, including inland transportation and customs clearance.

Case Study Achievements

JTEKT Corporation (formerly Toyota Industries Corporation)

|

|

|

Address

JAPAN TRUST

Nagoya head office

9th floor, Marunouchi Estate Building, 2-17-12, Marunouchi, Naka-ku, Nagoya, Aichi 460-0002 Japan

Tokyo head office

7th Floor, Shinagawa East One Towerbr 2-16-1,Konan, Minato-ku, Tokyo 108-0075 Japan 1

Osaka branch

2706 Branz Tower, 4-3-16, Minamihonmachi, Chuo-Ku, Osaka 541-0054 Japan