Transport Services to India

Republic of India

The Republic of India has Hindi as its official language, along with 21 other state-recognized languages as per its constitution. Commonly referred to as India, it is located in South Asia and is one of the most populous countries in the world. It shares borders with Pakistan, Nepal, China, Bhutan, Bangladesh, Myanmar, and Afghanistan. With a land area of approximately 3.29 million square kilometers, which is about 8.7 times that of Japan, India ranks ninth in the world and second in Asia in terms of size. Its population is around 1.4 billion, making it the most populous country in the world.

India has a rich history dating back to the Indus Valley Civilization (around 2500 BC) and has seen the rise of historic dynasties, including the Maurya and Gupta empires. It was a British colony from the 19th century until the mid-20th century, gaining independence in 1947.

India has a well-established education system, with a particular emphasis on higher and technical education. It is home to globally recognized institutions such as the Indian Institutes of Technology (IIT) and the Indian Institutes of Management (IIM).

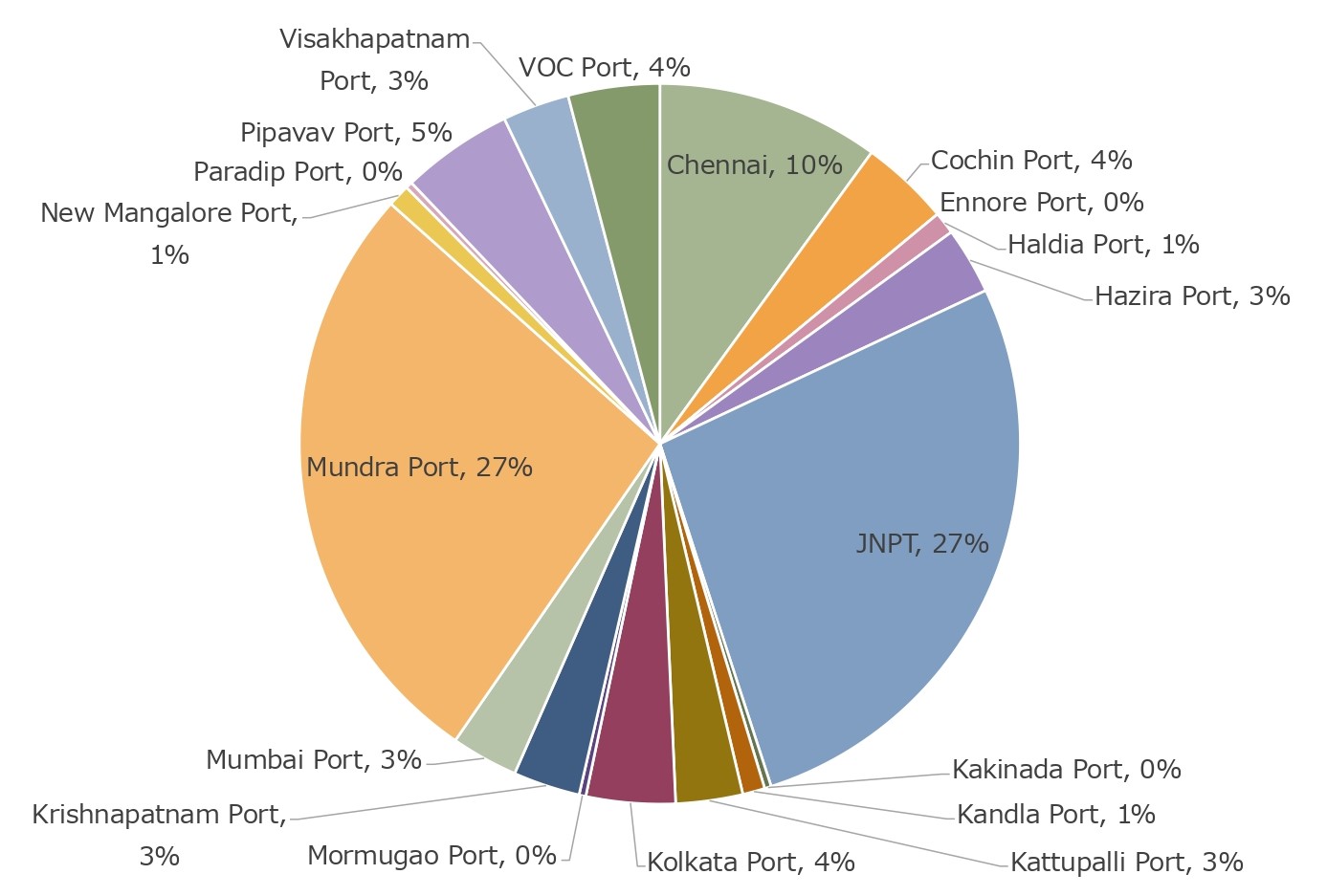

India boasts a coastline of 7,500 kilometers, with over 200 active ports. Currently, 20% of India’s cargo is transported by containers. The past decade of economic growth in India has spurred an increase in exports, leading to an improved level of containerization. There are 19 container ports in India, with 9 located along the western coast and 10 on the eastern coast. Among these, the ports of Mumbai, Chennai, and Kolkata serve as hubs for international trade.

Indian container terminals have recorded an annual growth rate of 6.5%, with the potential to reach a capacity of 25 million TEUs by 2025. While inland transportation infrastructure has been developed, further improvements are underway to enhance the efficiency of logistics.

Share of Each Container Port in India

Freight Costs for Shipments from Japan to India

Maritime Transport

| JNPT(NAVA SHEVA) | Transit Time via Singapore:15~25days |

| Mundra | Transit Time via Singapore:15~30days |

| Major Shipping Lines | MAERSK/MSC/CMA/HAPAG/ONE/EVERGREEN/YANG MING/HMM/WANHAI/IAL |

| Direct Service from Tokyo to Pipavav and Nava Sheva (23 to 25 Days) | |

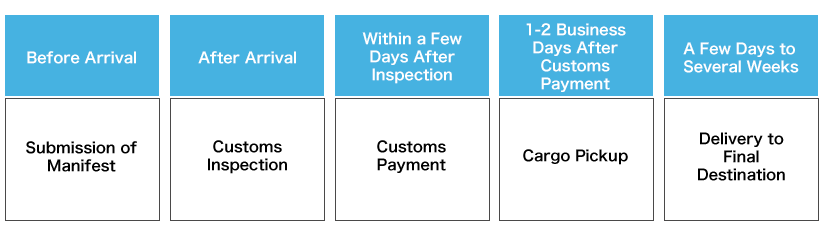

Customs Clearance

| 3~7days | ← This is only a guideline for the duration of the import customs clearance process.

(This applies if the importer meets the required conditions and there are no deficiencies in the documents.)

※Please note that unexpected rule changes or strikes may cause delays in customs clearance.

|

Typically, customs processing at ports in India takes about 3 to 7 days. However, this duration may vary depending on the type of cargo, the preparedness of customs documentation, and the congestion at customs.

◆Factors Affecting Customs Clearance

Preparation of Documents: It is crucial to have accurate customs documents (invoice, packing list, bill of lading, import/export permits, etc.). Any deficiencies can lead to delays in processing.

Type of CargoSpecific products or regulated items (e.g., chemicals, pharmaceuticals, food) may require additional inspections or permits.

Customs Examination: If the imported cargo is inspected by customs, the processing time may be extended. This is especially true for cargo considered high-risk or valuable, which may undergo stricter scrutiny.

Support from Customs Brokers: Utilizing experienced customs brokers or forwarders can facilitate smoother customs procedures.

◆Priority Clearance

Express Clearance Service: Some customs brokers offer express clearance services that can reduce the usual processing time. This may incur additional charges, but it can be effective in tight deadlines.

To conduct import/export operations, obtaining and updating the Importer-Exporter Code (IEC) is mandatory based on the 2023 Foreign Trade Policy, Item 1.13. Detailed requirements for necessary documents can be found in the DGFT's "Hand Book of Procedures."

Corporate Tax System in India

| Item | tax rate |

|---|---|

| Basic Customs Duty | 10% |

| Social Welfare Surcharge | 10% |

| Integrated Goods and Services Tax (IGST) | 18% |

Container Port in Indian

Address

JAPAN TRUST

Nagoya head office

9th floor, Marunouchi Estate Building, 2-17-12, Marunouchi, Naka-ku, Nagoya, Aichi 460-0002 Japan

Tokyo head office

7th Floor, Shinagawa East One Towerbr 2-16-1,Konan, Minato-ku, Tokyo 108-0075 Japan 1

Osaka branch

2706 Branz Tower, 4-3-16, Minamihonmachi, Chuo-Ku, Osaka 541-0054 Japan